Tyler Sewall and Cameron Mabley of BuiltWorlds examine global venture capital activity in construction and infrastructure

Infrastructure technology, or solutions used for the planning and design, execution and maintenance of assets including transportation, power, water, data and beyond, has in recent quarters been the darling of built world venture activity in North America.

This focus is, in large part, due to recent legislative activity such as the Inflation Reduction Act (IRA) and Bipartisan Infrastructure Law (BIL), both earmarking hundreds of billions of dollars for specific infrastructure improvement initiatives.

In heavily subsidizing the sector, public policy initiatives created a unique opportunity for increased adoption of technology solutions, and savvy investors took the opportunity to identify investment opportunities.

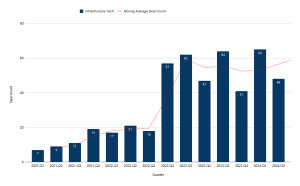

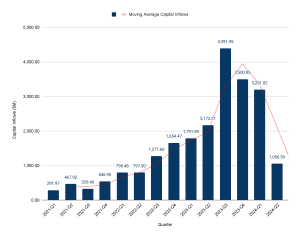

VC activity in this space, though, has recently slowed to $1bn across 46 deals in Q2 2024, compared with $3.2bn across 64 deals in Q1 2024. VC inflows in the first half of 2024 are substantially off the peak of $4.4bn of capital inflows across 65 deals in Q3 2023.

While the last two quarters showed a decline in investments, zooming out over the last two years provides a different narrative. Infrastructure Tech venture inflows are still up 31.6% compared with Q1 2022.

The last year and a half can be explained as investors playing catch up in a space with lots of opportunity, partially propelled by government spending tailwinds, and has seen minimal investment since the Eisenhower administration in the 1950s. Now that investors have established a presence, they are shifting to a period of portfolio management to monitor how these investments play out.

The pullback in venture dollars that we saw in Q2 2024 is also explained by the early government spending packages reaching the end of their lifespan in the VC markets. Round sizes are beginning to normalize for energy start-ups, a big driver of infrastructure tech investments, signaling an end to the legislative tailwinds propelling the space. This is all to say that the energy sector remains strong but is returning to a more sustainable state.

Energy remains a target for investors

Significant increases in capital inflows to infrastructure tech were bolstered largely by later-stage and strategic funding rounds in the grid-scale renewable energy space.

While prevalent over the last couple of years, no larger deals in this category took place in the first half of 2024. Prior to that, Q3 and Q4 2023 saw six deals in the energy and utility spaces with an average round size of $1.13bn, during a time when venture capital was hard to come by.

Despite the Q2 slowdown, energy and utilities are still attracting a significant portion of VC activity in the built world in 2024, though at more normalized round sizes.

Top 5 categories of Q1 2024

- Energy: $2.04bn, 28 deals.

- Mobility (EV Charging): $421.8m, 6 deals.

- Fleet management & monitoring: $303m, 5 deals.

- Energy systems & HVAC: $290.2m, 11 deals.

- Utilities: $267.8m, 11 deals.

Top 5 categories of Q2 2024

- Energy: $374.3m, 23 deals.

- Mobility: $283.6m, 8 deals.

- Utilities: $244.2m, 8 deals.

- High-performance materials: $189.7M, 12 deals.

- Equipment & machinery marketplace solutions: $108m, 1 deal.

With the EV infrastructure market slowing substantially in 2024, the EV space is beginning to feel the pressures of the consumer market. The US consumer has signaled they are not yet ready for wide-scale EV adoption; therefore, the lofty charging network plans are stalling. The hype of EV charging startups is fading as investments in this space fell by 32.8% quarter-over-quarter.

Investors are still heavily monitoring the infrastructure space and remain interested. However, it is also true that interest does not always equate to investment dollars.

Over the last two years, opportunistic investors put a lot of funding in infrastructure and now they’re letting that capital go to work as the US supports more infrastructure construction projects. It is likely there will continue to be activity in infrastructure tech given the continued funding. Still, the initial excitement from new policy creation has waned.

Explaining global venture capital movement

There are lots of things to take into consideration when it comes to the speed of adaptation in the VC space: fund lifecycles, interest rates and technology trends are just some that are currently impactful in the built world.

For example, some built world VC firms are in the process of closing or raising their next funds. This means that the first waves of capital are coming to the end of their deployment and the next waves are just beginning. These lifecycles can impact the volume of investment.

VC activity is also in some ways tied to interest rate movements, and this period of higher-for-longer rates has led to a more capital-constrained environment compared with 2022 and prior years.

Interest rates impact startup valuations, borrowing costs and other investment mechanisms that have contributed to a slowdown of venture activity across all industries over the last year and a half.

Also, VCs can make investment decisions in a matter of weeks due to the fast pace of deals, created by an abundance of VC firms competing in the market.

Technological shifts require VCs to be nimble – for example, the speed at which VCs began investing in AI after the rise of Chat-GPT3.

In order to maximize returns, VCs invest at the earliest possible stages and ensure they are capitalizing on opportunities that, in a competitive market, multiple investors may be after.

Venture capital activity in North America vs Europe

Venture capital activity in North America vs Europe

A multitude of cultural and fiscal factors have led to the entrenchment of VC in the US. Between New York, as the global financial hub, and Silicon Valley, as the nexus of technology and VC, among other growing tech-friendly cities like Austin, Texas, Boston, Massachusetts and Raleigh, North Carolina, there is a high-degree of opportunity in the US for startups.

The ecosystem of eager entrepreneurs and venture capitalists in the US leads to a very competitive environment that moves more quickly than other regions. The US is rich with private capital that many startups are competing for; and, conversely, many investors vying for a limited number of future unicorn startups.

During the market normalization period in early-2023 when rate hikes led investors to tighten their purse strings and sidestep overfunded US startups, many investors sought refuge in European startups that did not experience the overfunding in 2022 that hindered US startups.

With cheap capital at the culmination of years of near-zero interest rates, investors were somewhat cavalier in their investments leading to overfunding of many startups.

European investors, with less capital at their disposal, did not overburden startups with large valuations and excess capital as they typically move slower than US VCs. European startups established themselves as more of a safe play with a reputation of being judicious with their capital.

More recently, the built world has experienced a globalization of US-based funds. Global investments are a way of hedging exposure in built world investing because construction market trends can vary drastically from one country to another. For example, Europe did not experience the infrastructure craze; they are more focused on residential and commercial renovation projects.

Global VC targets beyond infrastructure

The high-performance materials segment is establishing itself as a favorite among built world investors.

The need for stronger, cheaper, lighter and more sustainable materials is palpable and has staying power in this industry. Builders and manufacturers have always been on the quest to use the best materials at the lowest cost and that has emerged as a reliable investment category that investors are refocusing on.

The supply chain and procurement process in construction has its own unique set of needs that have not been met with existing marketplace solutions. This segment will continue to offer investment opportunities in order to meet a critical need that has hamstrung the built environment forever.

Investors are also excited about startups offering solutions for skilled labor shortages. The labor crisis is transcending borders and industries, resulting in a need for labor force augmentation – the process of using AI, robotics and other automation technologies to reduce worker redundancies and spend more time on more value-add activities.

Venture capital activity in North America vs Europe

Venture capital activity in North America vs Europe