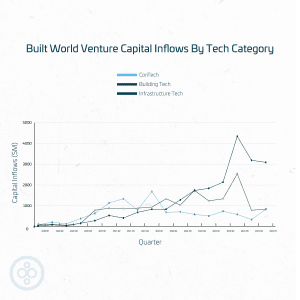

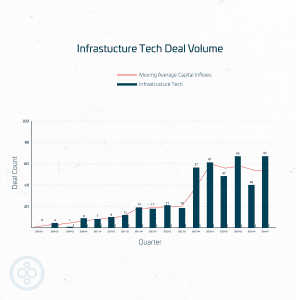

Infrastructure tech companies continue to be the top draw for venture capital investment companies interested in the built world, according to new research

The BuiltWorlds Q1 2024 Venture Report shows that among the built world tech companies seeing VC investment, infrastructure tech led by both capital inflows and deal count.

Both the report’s author, research analyst Cameron Mabley, and senior director of research Tyler Sewall note that VC infrastructure tech investments were particularly strong for energy companies in Q1 2024.

They pointed to incentives from the US government as a primary driver behind the relatively recent shift of interest.

Clean energy, energy storage and EV drive top deals

The top infrastructure tech deals in the first quarter of the year were:

- Recurrent Energy, solar energy – $500M venture (undefined) round.

- Ascend Elements, energy storage – $460M Series D.

- Electra, EV charging – $330M venture (undefined) round.

- Fervo Energy, geothermal energy – $244M venture (undefined) round.

- Sunfire, energy storage – $230M Series E.

Cameron Mabley, research analyst and the report’s author at BuiltWorlds, said: “Energy start-ups dominated the Q1 2024 with the top five raises all residing in the clean energy, energy storage or EV charging subsectors.

“The Infrastructure Investment & Jobs Act (or Bipartisan Infrastructure Law), the CHIPS Act and the Inflation Reduction Act have released over one trillion dollars into the sector to improve roads, highways and waterways, and to commit to the clean energy transition and expand the energy grid.

“The proliferation of data centers for cloud storage, large language model (LLM) processing for AI, electric vehicle charging stations and fossil fuel alternatives for the clean energy transition pose a capacity threat to energy grids worldwide.

“Echoing this problem, Blackrock CEO Larry Fink, largely considered one of the most influential investment leaders in the world, called out US infrastructure as one of the biggest restraints to domestic industry in his annual letter to the shareholders. The widespread acknowledgement of infrastructure shortfalls suggests that investment is only just beginning.”

‘Infrastructure a massive opportunity’

Tyler Sewall, senior director of research at BuiltWorlds, added: “Private capital was quick to follow the influx of government funding and attention towards our nation’s infrastructure projects.

“While innovation has more often in past years found its opportunities in commercial construction, the carrot offered by the federal government has shifted focus to transportation, data, waste/water and energy markets.

“Alternative energy solutions continue to be a focal point for sustainability and climate initiatives, in turn driving investors to seek opportunities in this space. It’s certainly not a new trend, but it is a trend more front of mind for many investors at this time.

“Infrastructure is a massive opportunity with trillions of dollars of capital required to maintain, enhance and build new assets to support our ecosystem. These are continuous initiatives that require continuous support, fueling increasing opportunities for technology to play a critical role.”